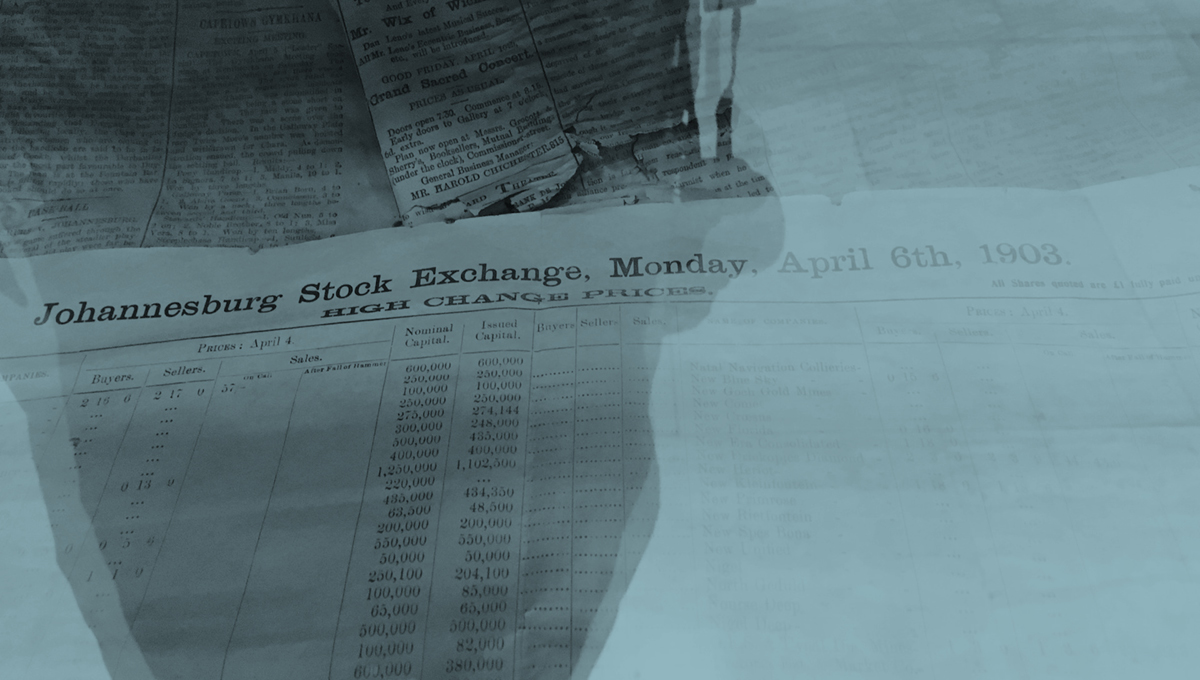

Since 1887, amid the fervour of the gold rush, the JSE has been pivotal in catalysing trade expansion, weaving itself into the fabric of the nation’s history.

Today, 136 years forward, the exchange stands at an evolutionary crossroads, beckoning a redefinition of its role amidst rapid technological shifts and emerging methods of capital acquisition.

- The Johannesburg Stock Exchange (JSE) has reached a pivotal moment 136 years after its founding.

- Historically, it has been a hub for enduring companies, contributing significantly to South Africa’s economy.

- Current trends show a worrying pattern of delistings among smaller companies due to regulatory challenges.

The JSE has been the bedrock for ‘mainstay’ companies that have powered South Africa’s economy for over a century. It’s legacy is adorned with the success stories of stalwart companies such as DRDGold, AbInBev, PPC, SAPPI, and Barloworld. These institutions underscore the exchange’s integral role in the financial tapestry of South Africa and the wider African continent.

Yet, the winds of change are blowing, evidenced by a troubling trend of delistings, particularly among small and mid-cap entities. The common thread in their departure is the onerous regulatory demands that hamper their ability to compete and thrive within the JSE’s framework.

“In response to the need for change, the JSE proposes a growth board — a beacon of hope for small and medium-sized enterprises.”

The JSE’s Main Board and AltX, with their uniform regulatory expectations, often impose a disproportionate strain on smaller ventures. It is within this context that the JSE’s proposed growth board emerges as a beacon of progress, poised to offer a more nuanced approach to regulation. This initiative seeks to recognize and address the diverse needs and capacities of companies, heralding a new era of inclusivity and support.

The envisioned growth board is a testament to the JSE’s commitment to nurturing small and medium-sized enterprises (SMEs). By providing a regulatory environment that is “effective and appropriate,” the growth board is designed to open doors, offering SMEs much-needed access to capital and the opportunity to flourish. This strategic pivot could significantly reduce the regulatory weight, spurring a new wave of listings and injecting fresh vigour into the marketplace.

“The JSE’s evolution is not just a reaction to current trends but a forward-looking vision for sustainable economic growth.”

In conclusion, the JSE’s ongoing transformation is more than a necessity – it’s an imperative for the sustained health and expansion of the capital markets. As it embraces the winds of change, the JSE must also cultivate fertile ground for the next generation of companies, ensuring a robust, diversified, and thriving economic landscape.

Final Thought

The JSE’s determination to adapt and evolve reflects a deep understanding of its role in economic stewardship. By fostering an environment that empowers emerging enterprises, the JSE reaffirms its place as a linchpin of growth and a beacon of opportunity for the African economy.

42 Wierda Road West,

42 Wierda Road West,